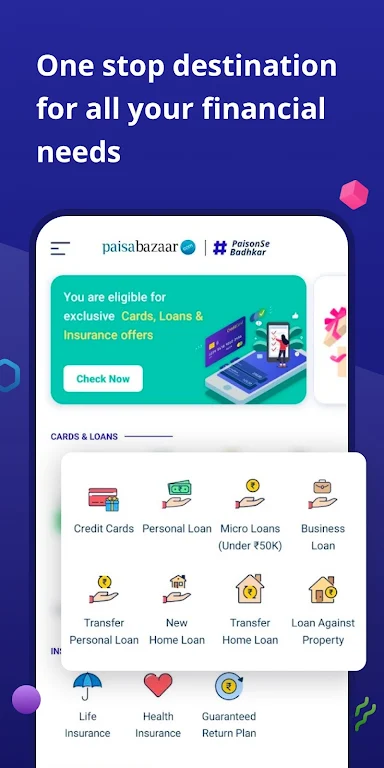

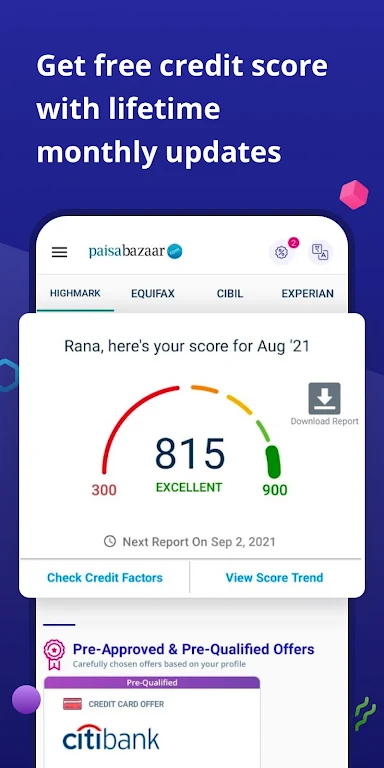

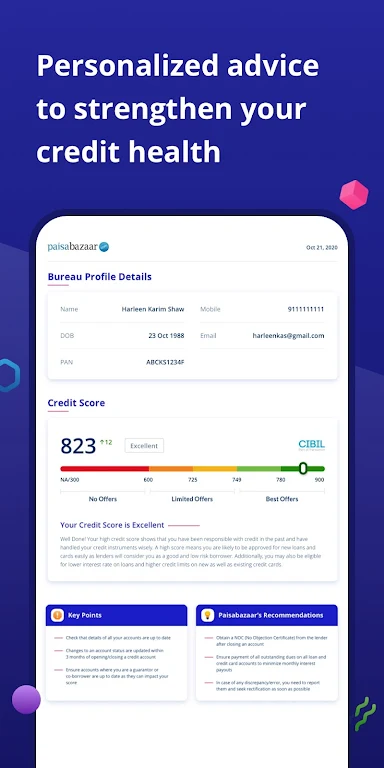

Empower your financial journey by downloading the CreditScore, CreditCard, Loans App today! This powerful tool offers you a comprehensive view of your financial health, providing a free credit report from multiple credit bureaus, including CIBIL. Stay on top of your financial game with regularly updated credit scores and discover personalized loan and credit card offers from India's leading banks and financial institutions. Whether you're seeking a credit card, a personal loan, or a home loan, the App presents an extensive selection to cater to your specific needs. Benefit from expert assistance, instant micro-loans, and pre-approved offers to make managing your finances smoother and more efficient. Join the ranks of over 22 million satisfied users and embark on your path to financial freedom with the app today.

Features of CreditScore, CreditCard, Loans:

- **Free Credit Report:** Access your credit report from multiple credit bureaus, including CIBIL, at no cost. Understand your credit standing and take steps to improve it.

- **Wide Range of Products:** Choose from offerings by 60+ partners, including 35+ credit cards and instant micro-loans. Find the perfect financial product to match your needs.

- **Personalized Offers:** Receive pre-approved loan and credit card offers tailored to your profile, with the convenience of instant disbursals.

- **Easy Comparison:** Utilize our digital platform to compare, select, and apply for the loan or card that suits you best, with expert guidance every step of the way.

- **Business and Home Loan Options:** Explore a variety of business loan offers and home loans with competitive interest rates, designed to help you achieve your bigger financial goals.

- **Secure Platform:** Keep track of all your debit and credit balances securely in one place, ensuring your financial information is protected.

FAQs:

**What is the repayment tenure for Personal Loans?**

- Personal Loans typically offer repayment tenures ranging from 3 months to 5 years, allowing you to choose a plan that fits your financial situation.

**How is the APR calculated for a Personal Loan?**

- The APR for a personal loan can range from 9% to 35%, based on your credit profile and the lender's terms. It's crucial to understand this rate to manage your loan effectively.

**What are the total costs involved in taking out a personal loan?**

- The total cost of a personal loan includes the principal amount, interest charges, loan processing fees, documentation charges, and amortization schedule charges. Be aware of these costs to plan your finances wisely.

Conclusion:

With its wide array of products, user-friendly comparison tools, and secure tracking features, CreditScore, CreditCard, Loans stands as your ultimate financial companion. Seize control of your finances and access the best loan and credit card offers from India's premier banks and financial institutions through a seamless digital experience. Make the smart choice for your financial future by embracing the app today.