In both everyday life and financial matters, fees and penalties (tasas y multas) play a crucial role in maintaining order and ensuring compliance with regulations. Whether you're dealing with government services, parking tickets, bank transactions, or legal processes, understanding the difference between fees (tasas) and penalties (multas), and their impact on your personal or professional responsibilities, is essential.

Features of Tasas y Multas:

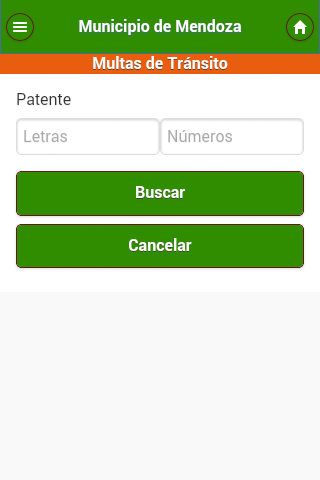

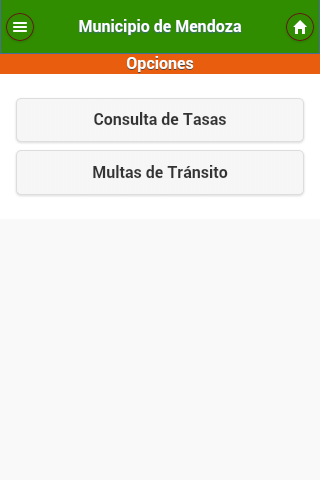

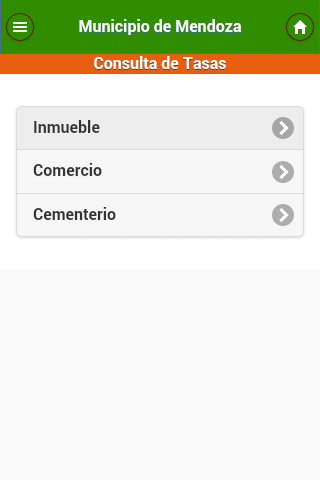

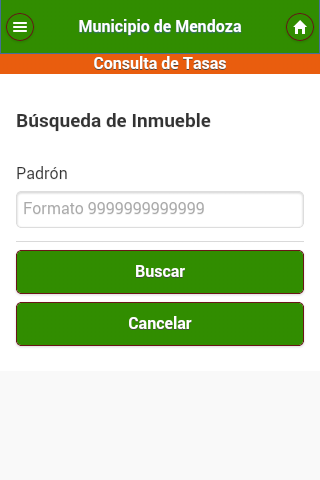

- Convenient Payment Options: The Tasas y Multas platform offers users the ability to pay their municipal consultation rates for property, cemetery, advertising, and fines easily. Users can opt to receive a payment receipt via email and generate an electronic payment for future transactions.

- Online Transactions: The app facilitates online payments through collection networks such as Banelco and Link Payments. This allows users to make secure payments from home, eliminating the need to visit municipal offices.

- Mobile Compatibility: Seamless integration with mobile payment apps like "BanelcoMOVIL" and "Link Cell" enhances the convenience of the payment process for users who already have these apps installed.

- Accruals and Payment Plans: The app calculates and generates accruals for new shares and provides updates on the start of coercion and expiration of payment plans, helping users manage their payment obligations effectively.

FAQs:

- Is my data secure when making online payments through the app?

Absolutely! The app prioritizes the security of your personal and financial information during online transactions, ensuring your data is protected. - Can I use the app to pay fines issued by other municipal authorities?

No, the app is specifically designed for paying municipal consultation rates, fines, and debts within its jurisdiction and may not be compatible with fines issued by other authorities. - How long does it take to receive a payment receipt via email?

The receipt is typically sent to your configured email account immediately after payment, though occasional delays due to network or server issues may occur.

What are Tasas?

Tasas, or fees, are charges levied for the use of specific services or for completing certain administrative processes. These fees vary depending on the service provider or authority involved. For instance, applying for a government document like a passport or driver's license incurs a tasa for processing. Other common types of fees include:

- Bank fees: Charges for account maintenance, transfers, or transactions.

- Service fees: Payments for utilities such as water, electricity, or waste management.

- Municipal taxes: Local government fees for services like road maintenance or public safety.

Tasas are generally predictable and governed by specific guidelines, allowing individuals to plan and budget for these costs effectively.

What are Multas?

Multas, or penalties, are fines imposed as a consequence of violating a law, rule, or regulation. Unlike fees, these are not regular charges but penalties for non-compliance. Common examples include:

- Traffic fines: Penalties for speeding, running red lights, or other violations.

- Tax penalties: Fines for late payments or incorrect tax filings.

- Business-related fines: Companies may incur multas for failing to comply with labor laws, environmental regulations, or safety standards.

Multas are intended to discourage undesirable behavior and encourage adherence to laws and regulations.

How to Manage Tasas y Multas

Staying informed about the tasas y multas you may encounter in various aspects of life is crucial. Here are some strategies to manage and minimize these costs:

- Stay Compliant: Adhere to rules and regulations to avoid penalties. For example, drive within speed limits, pay taxes on time, and maintain proper business practices.

- Be Aware of Deadlines: Keep track of deadlines for paying fees or submitting documentation to prevent incurring unnecessary multas.

- Review Your Statements: Regularly check bank or service statements to identify and manage any unexpected fees.

- Understand Local Regulations: Familiarize yourself with the tasas and multas structures in different regions or municipalities to better plan your finances.