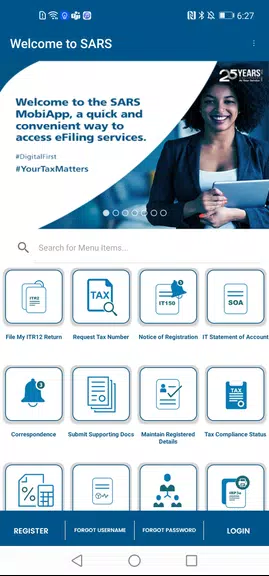

The SARS Mobile eFiling app revolutionizes tax filing in South Africa, offering a user-friendly mobile solution for completing and submitting Income Tax Returns. This innovative app empowers taxpayers with convenient on-the-go access to their annual returns, enabling them to save, edit, and manage their tax information directly from their smartphones or tablets. A built-in tax calculator provides valuable assessment estimations, aiding in effective financial planning. The app prioritizes security, ensuring the safe and reliable submission of sensitive tax data, providing peace of mind to users.

Features of SARS Mobile eFiling:

- Unmatched Convenience: File and submit your annual Income Tax Return anytime, anywhere, directly from your mobile device – simplifying the process significantly.

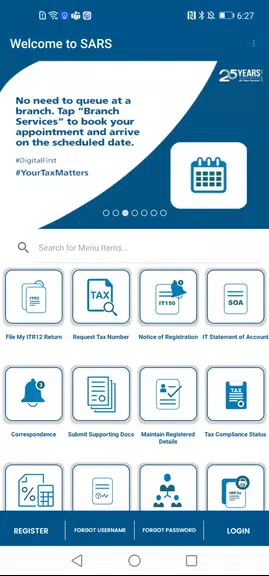

- Effortless Accessibility: Manage your taxes with ease, enjoying the flexibility to access the app at your convenience.

- Robust Security: Rest assured knowing your information is protected with secure encryption throughout the process.

- Smart Tax Calculator: Estimate your tax assessment with the integrated tax calculator, improving your budgeting and financial planning.

Frequently Asked Questions:

- Is the SARS Mobile eFiling app secure? Yes, the app employs robust security measures, encrypting all submitted information to safeguard user data.

- Can I access past tax returns through the app? Yes, you can conveniently view summaries of your Notice of Assessment (ITA34) and Statement of Account (ITSA) within the app.

- Can I use the app for business tax filings? Currently, the app is designed for individual taxpayers filing personal Income Tax Returns only.

Conclusion:

The SARS Mobile eFiling app is a game-changer for South African taxpayers. Its convenient, accessible, and secure features streamline the tax filing process, making it simpler for both seasoned and new eFilers. Download the app today and experience the ease and control of managing your taxes on the go.